Mon - Sat: 8:00 am - 5:00 pm

Let's talk

Your Tax Solutions Partner, Call (+254) 797 777077

Please Mail Us: info@taxexperts.co.ke

Monthly rental income in Kenya means payments received from a right granted to another person for use or occupation of immovable property which includes premium or similar consideration received for the use or occupation of property.

Monthly Rental Income or MRI was introduced through the Finance Act 2015 and came into effect on 1st Jan 2016.

MRI is payable by residents (individuals or companies) on rental income accrued or derived from the use or occupation of residential property in Kenya.

Following the enactment of the Finance Act 2020, MRI applies to individuals earning rental income exceeding two hundred and eighty thousand shillings but not exceeding fifteen million shillings during any year of income, effective from 1st January 2021.

However, individuals can elect not to be taxed under MRI by providing written notice to the Commissioner. In such cases, the annual income tax regime will apply.

Property owners with rental income exceeding Kshs. 15 million per year must declare their rental income along with other incomes when filing their annual income tax returns.

The rate of tax is 7.5%, effective 1st January 2024, on the gross rent received which is final tax. No expenses, losses or capital deductions are allowed for deduction.

The Finance 2023 Act introduces a provision for appointing rental income tax agents to collect and remit rental income tax to the Commissioner, effective 1st July 2023. Starting 1st January 2024, the tax will be charged at 7.5% and must be remitted by the fifth working day after deduction. The Commissioner retains the authority to revoke this appointment at any time.

Where a person deducts MRI he shall within five working days after the deduction was made remit the amount so deducted to the Commissioner together with a return in writing of the payment of the amount of tax deducted.

Late filing of MRI returns attracts a penalty of:

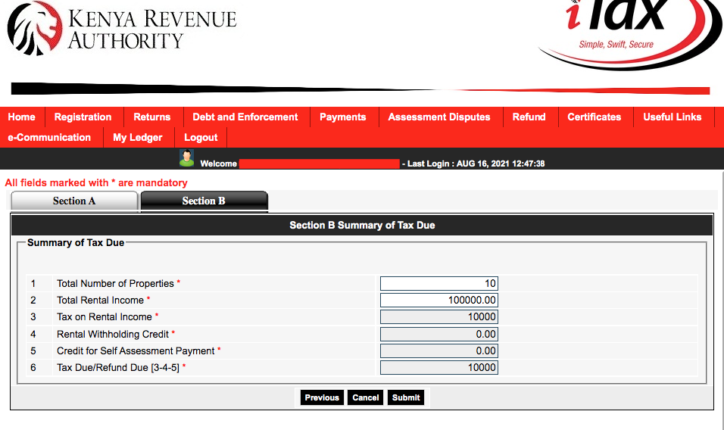

After filing the MRI return, generate a payment slip as follows;

Gross Rent income for the year:

Property A – 5 units*Kshs. 20,000*12months 1,200,000

Property B – 10 units*Kshs. 15,000*12months 1,800,000

Total Rent income in Kshs. 3,000,000

Less: Allowable expenses (Kshs.):

Land Rent/Rates 10,000

Insurance 20,000

Agent’s fees 30,000

Repairs 160,000

Loan interest 85,000

Electricity 60,000

Net taxable rent income (Kshs.) 2,635,000

We are here to help you Navigate Kenyan taxes landscape, Talk to us https://taxexperts.co.ke/contact-us/

Rental Income is filed on or before the 20th of the following month. For example, rent received in January is declared and tax paid on or before 20th February.

Residential rental income is final tax and not required to declare the same in their annual income tax returns.

You can now also file and pay your monthly rental income tax using the new https://kra.go.ke/