Mon - Sat: 8:00 am - 5:00 pm

Let's talk

Your Tax Solutions Partner, Call (+254) 797 777077

Please Mail Us: info@taxexperts.co.ke

Tax exemption for persons with disabilities (PWDs) in Kenya; established under the Persons with Disabilities Act, 2003, and further supported by the Persons with Disabilities (Income Tax Deductions and Exemptions) Order, 2010. This legal framework ensures that individuals with disabilities who earn an income can apply for tax exemptions on their income. The exemption applies to the first Ksh. 150,000 per month or Ksh. 1.8 million per year. This article explores the details of the tax exemption process, requirements, and the benefits for PWDs in Kenya.

For more insights, visit Tax Experts Kenya or contact us at info@taxexperts.co.ke or call 0797 777077 for personalized tax consultations.

To qualify for the Tax exemption for persons with disabilities (PWDs) in Kenya, the applicant must meet specific criteria. This ensures that only deserving individuals receive the benefit of tax relief. Below are the key conditions:

For more details on the eligibility criteria, contact us at info@taxexperts.co.ke or call 0797 777077 for personalized tax consultations..

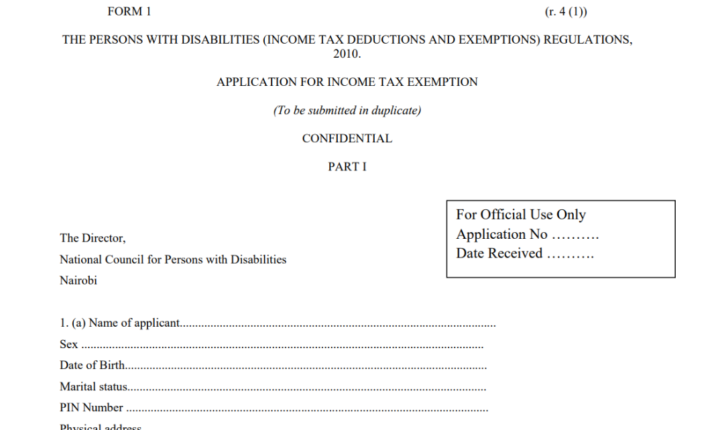

The application process for tax exemption for persons with disabilities in Kenya involves several steps. Below is a simplified guide to applying for tax exemption:

Applicants must attach the following:

For professional assistance with filling these forms, contact us at info@taxexperts.co.ke or call 0797 777077.

For more information on the application process, contact us at info@taxexperts.co.ke or call 0797 777077.

The tax exemption certificate is valid for five years. Applicants must reapply for the exemption upon expiry. The renewal process follows the same procedure as the initial application.

Persons with disabilities in Kenya are also entitled to tax exemptions on the importation of vehicles. The following are the key requirements:

For additional requirements, such as proof of payment and bank statements, reach out to us at info@taxexperts.co.ke.

The tax exemption helps persons with disabilities retain a significant portion of their earnings, enabling them to cater to their personal and medical needs. This legal provision promotes financial independence and ensures that PWDs can live dignified lives without the heavy burden of taxation.

For more personalized assistance with tax exemption applications, vehicle importation, or any other tax-related queries, feel free to contact us at info@taxexperts.co.ke or call 0797 777077.